The Ledger of Large Model Companies: A Race of Burning Money and Survival Realities

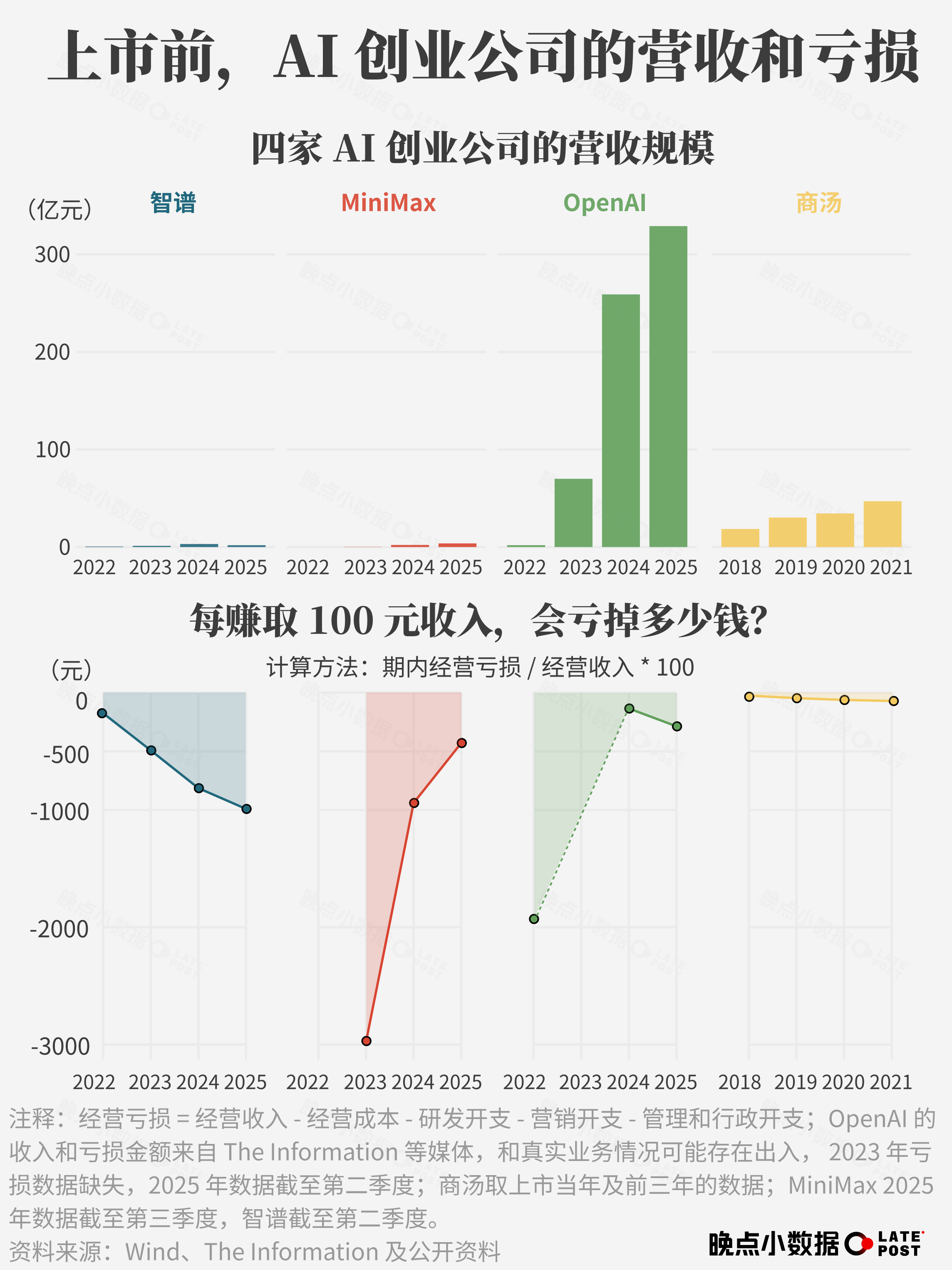

The prospectuses of Zhipu and MiniMax reveal the survival state of pure large model startups: burning 11 billion RMB over three years, with revenue barely covering computing costs, yet trapped in a cycle of continuous investment.

Training a competitive large language model requires tens of thousands of AI computing cards running at full speed for several months. Data centers are as hot as furnaces, electricity meters spin nervously, and bills run into billions.

However, these hefty investments yield models with an astonishingly short shelf life. In the large model arena LMArena, 26 models have already dropped out of the top five this year after briefly breaking in. The once-promising DeepSeek-R1, which shone brightly at the beginning of the year, now ranks outside the 60th place.

The pace of model iteration leaves companies with no choice but to keep going. The prospectuses of Zhipu and MiniMax show how pure large model startups, without the lifeline of e-commerce, advertising, or other businesses, manage to survive.

Over the past three and a half years, the two companies have burned through a total of 11 billion RMB, half of which went to cloud providers for computing rentals. This explains why Alibaba Cloud has seen strong growth in recent years—according to our sources, some Chinese AI companies spend more on computing at Alibaba Cloud than these two.

They have chosen different paths. Zhipu focuses on the enterprise market, with 70% of its revenue coming from locally deployed large model systems, yielding a gross margin of about 60%. The problem lies in customer retention—over the past three and a half years, its top five clients have changed every year. This means constantly searching for new customers and relying on manpower to maintain revenue.

MiniMax targets individual users, with 70% of its revenue coming from products like Starry Sky/Talkie, which charge membership fees, sell virtual goods, or insert ads to global users. By September 2025, these products had 27.6 million monthly active users. The cost is high reasoning computing power, and its business gross margin only turned positive in the first three quarters of this year, not to mention billions spent on marketing.

After accounting for R&D, marketing, and other costs, the two companies burn through multiple times, or even ten times, the funds they earn for every 100 RMB they make. Their efficiency is lower than that of Megvii when it went public and comparable to OpenAI. But OpenAI has 800 million weekly active users, with a revenue of 32.9 billion RMB in the first half of the year—100 times the combined total of these two companies.

Fundraising ability has become key. Zhipu claims to have 8.9 billion RMB in available funds, but over 70% of it is bank credit. MiniMax, which has raised more funds, still had 7.35 billion RMB in cash by September, with 60% of it invested in wealth management.

Going public can open up new fundraising channels, but burning money cannot stop. To attract investors, companies must continuously train better models. Especially MiniMax, which aims to maintain an advantage in video and image generation, needs to make up for the shortcomings of its underlying language models, which require greater investment.

Better models are the foundation of both the business and the narrative, and also an inescapable cycle. (Text & Images | He Qianming, Huang Zhixin; Edited by Huang Junjie)

发布时间: 2025-12-26 08:05